Unlocking Financial Access with Agent Banking Solutions in Saudi Arabia and Pakistan

Agent banking is boosting financial access in Saudi Arabia and Pakistan, bringing secure, inclusive, and convenient banking to underserved communities.

In an era where financial accessibility is a critical element of social and economic development, Agent Banking Solutions are playing a pivotal role in transforming the landscape of banking services. As Saudi Arabia (KSA) and Pakistan aim to promote financial inclusion, mobile banking solutions and agent banking systems are becoming essential tools in bridging the gap for underserved populations. With MYTM, a leading provider of Agent Banking software, financial inclusion banking has become more efficient, secure, and easily accessible.

Understanding Agent Banking Solutions:

Agent banking refers to the provision of financial services through authorized agents, often in locations that are more convenient and accessible than traditional bank branches. By partnering with these agents, banks can reach rural and remote areas where brick-and-mortar branches are scarce. This model helps increase financial inclusion by offering essential banking services like deposits, withdrawals, and money transfers in a more user-friendly and widespread manner.

In Saudi Arabia and Pakistan, where a significant portion of the population remains unbanked or underbanked, agent banking solutions offer an opportunity to change that narrative. By leveraging mobile banking solutions, MYTMs agent banking software enables seamless transactions, ensuring that even individuals in the most remote areas can participate in the financial ecosystem.

The Importance of Financial Inclusion in Saudi Arabia and Pakistan:

Both Saudi Arabia and Pakistan are striving towards financial inclusion, a key component of their economic development strategies. In Saudi Arabia, financial inclusion is a major pillar of Vision 2030, which aims to reduce the reliance on cash transactions and promote digital banking. Similarly, in Pakistan, where nearly 100 million adults remain outside the formal banking system, financial inclusion is essential to improving access to credit, savings, and other financial services that can drive economic growth.

Agent banking solutions help accelerate this transition. By providing low-cost, accessible banking services through MYTMs software, individuals in remote areas can manage their financial needs without the burden of traveling to distant branches. This is particularly important in Pakistans rural regions, where mobile banking solutions are proving to be a game changer.

How MYTMs Agent Banking Software Revolutionizes Mobile Banking Solutions:

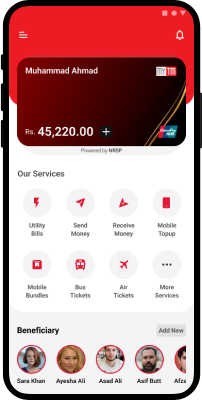

MYTM's Agent Banking Solutions offer an array of features that cater to both banks and their customers. With its robust, secure platform, MYTM ensures that agents can perform a range of banking operations, including bill payments, fund transfers, and account openingall from the palm of their hand. The simplicity and convenience of MYTMs agent banking software make it an ideal choice for mobile banking solutions in Saudi Arabia and Pakistan.

Heres how MYTMs agent banking software is transforming financial services:

-

Accessibility: MYTMs agent banking solution ensures that banking services are available anywhere, whether in urban cities or remote rural areas, breaking down geographical barriers.

-

Security: With high-level encryption and secure authentication processes, MYTM guarantees that all transactions remain safe and protected from fraud.

-

Cost-Effective: For agents and financial institutions alike, MYTMs platform is a cost-efficient solution that reduces operational overheads while enabling access to new customers.

-

Seamless Integration: MYTMs software integrates effortlessly with banks' core systems, enabling real-time updates on customer accounts and transaction histories.

Benefits of Mobile Banking Solutions for Financial Inclusion:

Mobile banking solutions are not only improving accessibility but also enhancing financial literacy among unbanked populations. With mobile phones being a ubiquitous tool in both Saudi Arabia and Pakistan, integrating mobile banking solutions into agent banking systems offers a powerful way to reach a wider audience.

For example, MYTMs mobile banking platform ensures that users can:

-

Transfer money across borders and within the country with minimal fees.

-

Access micro-loans or savings accounts designed for people with little to no credit history.

-

Make payments or purchase airtime directly from their phones, all within a secure, easy-to-use interface.

In Pakistan, where mobile penetration is steadily growing, mobile banking offers a unique opportunity for the government to extend financial services to the masses. Similarly, in Saudi Arabia, the push for digital transformation aligns perfectly with the implementation of mobile banking solutions as a means of improving financial accessibility for all residents.

Conclusion:

As financial inclusion becomes a central focus in both Saudi Arabia and Pakistan, Agent Banking Solutions powered by MYTMs cutting-edge software provide the key to unlocking financial access for millions of people. Through the integration of mobile banking solutions and efficient agent banking services, these countries are well on their way to a more financially inclusive future. With MYTMs innovative platform, the promise of universal access to financial services is becoming a reality, transforming lives and communities one transaction at a time.

By embracing agent banking solutions, financial institutions can play an active role in fostering economic growth, financial literacy, and independence across Saudi Arabia and Pakistan.