UAE Electric Vehicle Market Growth, Size, and Trends Forecast 2025-2033

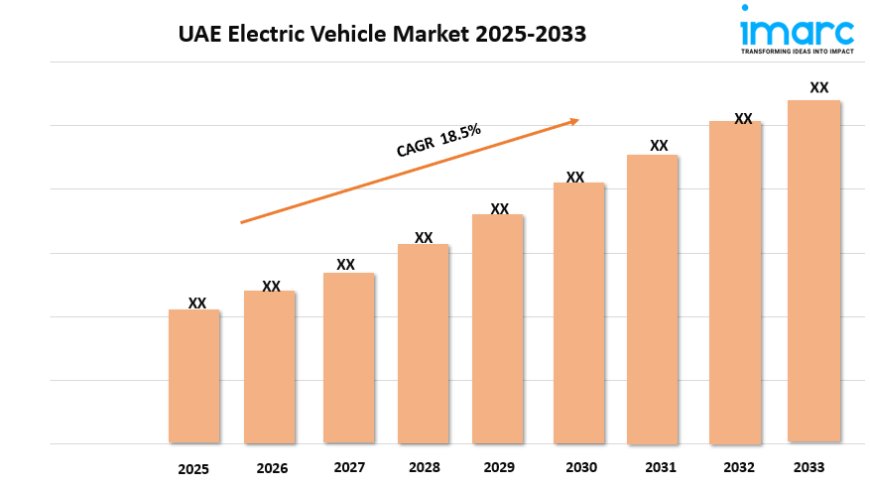

The UAE electric vehicle market size reached USD 2.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.0 billion by 2033, exhibiting a growth rate (CAGR) of 18.5% during 2025-2033.

UAE Electric Vehicle MarketOverview

Market Size in2024:USD 2.4 Billion

Market Size in2033:USD11.0 Billion

Market Growth Rate 2025-2033:18.5%

According to IMARC Group's latest research publication,"UAE Electric Vehicle Market Report by Component (Battery Cells and Packs, Fuel Stack, On-Board Charger, Electric Motor, Brake, Wheel and Suspension, Body and Chassis, and Others), Propulsion Type (Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-In Hybrid Electric Vehicle (PHEV)), Vehicle Type (Passenger Vehicles, Commercial Vehicles, and Others), and Region 2025-2033", theUAE electric vehicle marketsizereached USD 2.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.0 billion by 2033, exhibiting a growth rate(CAGR) of 18.5%during 2025-2033.

Growth Factors in theUAE Electric Vehicle Market

- Government Initiatives and Incentives

The UAE governments commitment to sustainability is a major driver of the electric vehicle (EV) market. Policies like Dubais Green Mobility Strategy 2030 aim to make a significant portion of public and private vehicles electric or hybrid. Incentives such as free parking, toll exemptions, and subsidized charging make EVs more appealing. For instance, the Dubai Electricity and Water Authority (DEWA) offers free charging at public stations, reducing ownership costs. These measures align with the UAEs Vision 2021 and Energy Strategy 2050, encouraging consumers and businesses to adopt EVs, fostering a culture of eco-conscious transportation across the Emirates.

- Expanding Charging Infrastructure

A robust charging network is critical for EV adoption, and the UAE is rapidly expanding its infrastructure. Dubai alone has over 300 public and private charging stations, with plans for over 1,000 by 2025, led by DEWAs Green Charger Initiative. Abu Dhabi aims for 70,000 charging points by 2030, supported by partnerships like E2GO, a joint venture between ADNOC Distribution and Taqa. These efforts address range anxiety, as seen in the case of a Dubai-based delivery company that switched to EVs after reliable charging stations became available near its logistics hubs, boosting operational efficiency.

- Rising Consumer Demand for Sustainability

Growing environmental awareness among UAE residents is fueling EV demand. With increasing concerns about climate change, consumers are choosing EVs for their zero-emission benefits. Public campaigns and media highlighting lower operating costs, like the 88% fuel savings compared to traditional vehicles, resonate with affluent buyers. For example, a 2023 survey showed 30% of UAE residents considered purchasing an EV, driven by eco-friendly preferences. Luxury brands like Tesla and Lucid have capitalized on this, offering high-end models that align with the UAEs affluent market, further accelerating adoption.

Key Trends in theUAE Electric Vehicle Market

- Luxury EV Market Expansion

The UAEs affluent population has spurred a surge in luxury EV sales, particularly SUVs and large cars, which dominate with a significant market share. Brands like Tesla, Mercedes-Benz, and BMW offer premium models tailored to consumer preferences for spacious, high-performance vehicles. For instance, Nissans Ariya SUV, launched in the UAE with a 610-km range, has gained traction among luxury buyers. This trend is supported by rental firms adopting EVs for premium services, catering to tourists and residents seeking sustainable yet prestigious transport options, reinforcing the UAEs status as a luxury EV hub.

- Technological Advancements in Charging

Innovations in charging technology are transforming the UAEs EV landscape. Solar-powered charging stations, trialed by DEWA in 2020, align with the UAEs renewable energy goals. Partnerships like the Sharjah Research, Technology, and Innovation Park (SRTIP) are developing faster chargers to reduce charging times. For example, ABBs Terra 360 charger, capable of charging multiple vehicles simultaneously, has been deployed in Dubai, enhancing convenience. These advancements make EVs more practical for daily commuters and long-distance travelers, supporting the UAEs ambition to lead in clean energy transportation.

- Commercial Fleet Electrification

The commercial sector is rapidly adopting EVs, driven by government mandates and cost benefits. E-commerce and logistics companies, like a Dubai-based delivery firm that transitioned its fleet to electric vans, are reducing operating costs and emissions. The UAEs focus on smart cities has led to electric buses in public transport, with Dubais Roads and Transport Authority integrating EVs into its fleet. This trend is bolstered by policies mandating a percentage of public sector vehicles to be electric, creating a ripple effect across industries like hospitality and logistics, enhancing market growth.

Download a sample PDF of this report:https://www.imarcgroup.com/uae-electric-vehicle-market/requestsample

UAE Electric VehicleIndustry Segmentation:

The report has segmented the market into the following categories:

Component Insights:

- Battery Cells and Packs

- Fuel Stack

- On-Board Charger

- Electric Motor

- Brake, Wheel, and Suspension

- Body and Chassis

- Others

Propulsion Type Insights:

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Others

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Future Outlook

The UAE EV market is poised for significant growth, driven by sustained government support, infrastructure expansion, and evolving consumer preferences. With ambitious goals like converting a substantial portion of vehicles to electric by 2030, the UAE is set to become a regional leader in sustainable mobility. Continued investments in charging networks, such as Abu Dhabis plan for 70,000 charging points, will address accessibility challenges. Technological innovations, including faster chargers and battery advancements, will enhance EV appeal. However, challenges like limited dealer networks and technician training must be addressed to sustain momentum. With strategic partnerships and policies, the UAE is well-positioned to achieve its green mobility vision.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145