RegTech Market Size, Growth, and Trends Report 2025-2033

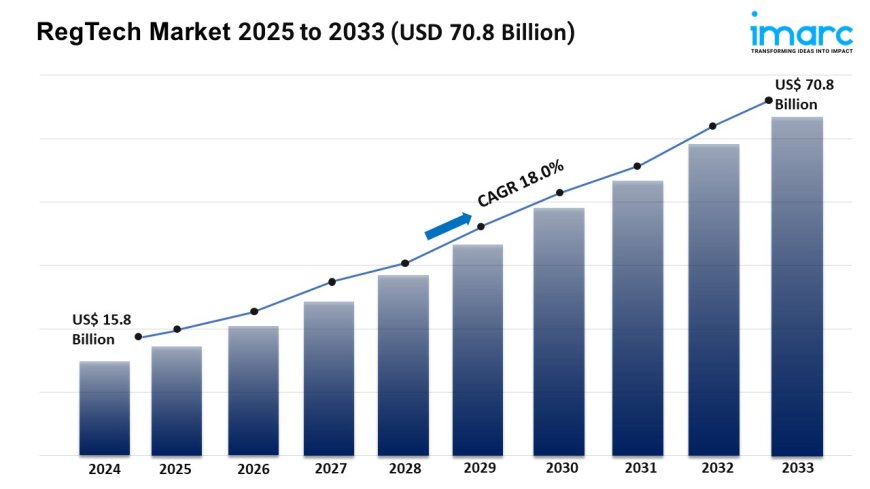

The global RegTech market size was valued at USD 15.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 70.8 Billion by 2033, exhibiting a CAGR of 18.0% from 2025-2033.

Market Overview:

The RegTech market is experiencing rapid growth, driven by increasing regulatory complexity, advancements in technology, and cost reduction and efficiency gains. According to IMARC Group's latest research publication, "RegTech Market Size, Share, Trends, and Forecast by Component, Deployment Mode, Enterprise Size, Application, End User, and Region, 2025-2033?", the global RegTech market size was valuedatUSD 15.8 Billionin 2024. Looking forward, IMARC Group estimates the market to reachUSD 70.8 Billionby 2033, exhibiting aCAGR of 18.0%from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/regtech-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the RegTech Market

- Increasing Regulatory Complexity

The increasing complexity of regulations in various sectors is a major stimulus for the RegTech industry, significantly influencing the RegTech market size in 2025. Financial services, healthcare, and even energy production and consumption must comply with a multitude of rules such as anti-money laundering (AML), general data protection regulations (GDPR), and environmental compliance. Not only are these regulations difficult to keep track of, but they also differ depending on the regions where businesses operate. In RegTech, we see many firms developing solutions to support organizations with compliance. An example is ComplyAdvantage, which uses AI to manage financial crime detection risks and allows businesses to comply with their obligations in real time. The need for organizations to comply with regulations sooner offers great opportunities for utilizing technology to identify compliance risks earlier and mitigate potential fines, should things go wrong, further driving the RegTech market size in 2025.

- Advancements in Technology

Advances in technology, combined with developments in artificial intelligence (AI), machine learning (ML), and blockchain, are helping drive the RegTech market forward, contributing to the projected RegTech market size in 2025. These technological developments enable faster and more accurate data analysis, as well as boost transparency in compliance processes. For example, AI-based applications can process massive amounts of data (data lakes) to recognize and analyze patterns of fraud or non-compliance; blockchain provides secure monitoring of compliance information while permitting an immutable record. Chainalysis, a blockchain analytics company, assists institutions with tracking crypto-based transactions to meet compliance deadlines. Companies embracing digital transformation effectively can drive the RegTech market size in 2025, with advanced technology integration into products and services that provide scalable and affordable solutions, enhancing compliance to increasingly higher standards of accountability.

- Cost Reduction and Efficiency Gains

The need to reduce operational costs while maintaining compliance is a key growth factor for the RegTech market, significantly impacting the RegTech market size in 2025. Traditional compliance methods, often manual and time-consuming, are prone to errors and inefficiencies. RegTech solutions automate repetitive tasks, such as data collection and reporting, allowing organizations to allocate resources more effectively. For example, Ascent Technologies offers a platform that automates regulatory change management, helping firms stay compliant without extensive manual intervention. By reducing the time and costs associated with compliance, RegTech enables businesses to focus on core activities, driving market demand as organizations prioritize efficiency in an increasingly competitive landscape, further expanding the RegTech market size in 2025.

Key Trends in the RegTech Market

- Adoption of AI and Machine Learning

AI and ML are two notable trends in the RegTech solutions market. The use of these technologies improves the quality of compliance activities by facilitating predictive analytics, anomaly detection, and faster automated decision-making. As an example, companies such as Tookitaki, employ AI in order to produce AML screening tools that adapt to changes in risk patterns, while delivering data in real-time. This trend has a huge scope in financial services, where there is ongoing scrutiny from regulators. The cost of AI and ML technology is also coming down. RegTech providers are making up-user friendly platforms that utilize these technologies, and can be adopted by companies of all sizes. This will make RegTech more useful and beneficial to help companies deal with the challenges of compliance work.

- Focus on Data Privacy and Cybersecurity

With data breaches and privacy concerns on the rise, RegTech solutions are increasingly focused on data protection and cybersecurity compliance. Regulations like GDPR and CCPA require businesses to safeguard consumer data, creating demand for tools that ensure compliance while securing sensitive information. Companies like OneTrust offer RegTech platforms that automate privacy management, helping organizations comply with global data protection laws. This trend is driven by growing consumer awareness and stricter penalties for non-compliance, pushing businesses to invest in robust RegTech solutions that address both regulatory and cybersecurity challenges, thereby enhancing trust and operational resilience.

- Cloud-Based RegTech Solutions

The growth of cloud-based RegTech solutions is a key trend that provides scalability, flexibility, and cost savings in a world where the demands of the regulatory environment continue to evolve. Cloud platforms and cloud services enable continual updates to be performed to an organizations existing systems, allowing GRC platforms to maintain relevance in constantly changing situations. See, for example, MetricStream cloud governance, risk, and compliance (GRC) solutions that allow organizations to handle compliance in case and multi-jurisdictional management applications. This is attractive to small and medium-sized enterprises (SME's) that do not have the time and budget associated with on-premise systems. With the adoption of cloud computing amongst small and mid-sized firms, RegTech providers are using cloud technology to continue to produce cost-efficient, accessible, and user-friendly solutions to continue expanding RegTech and compliance-based solutions in the market.

Leading Companies Operating in the Global RegTech Industry:

- ACTICO GmbH

- Acuant Inc.

- Ascent

- Broadridge Financial Solutions Inc.

- ComplyAdvantage

- Deloitte Touche Tohmatsu Limited

- International Business Machines Corporation

- Jumio

- London Stock Exchange Group plc

- MetricStream Inc.

- NICE Ltd.

- PricewaterhouseCoopers

- Thomson Reuters Corporation

- Trulioo

- Wolters Kluwer N.V.

RegTech Market Report Segmentation:

By Component:

- Solution

- Services

Solution represents the largest segment as it encompasses a wide range of tools and technologies, including compliance management software, risk assessment platforms, regulatory reporting systems, and monitoring tools.

By Deployment Mode:

- Cloud-based

- On-premises

On-premises accounts for the majority of the market share due to the concerns surrounding data privacy and sovereignty across various industries.

By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises hold a 65.0% market share in 2024, utilizing RegTech to manage vast data volumes, enhance efficiency, and improve customer experiences with advanced technologies like AI and big data analytics.

By Application:

- Anti-Money Laundering (AML) and Fraud Management

- Regulatory Intelligence

- Risk and Compliance Management

- Regulatory Reporting

- Identity Management

Risk and compliance management leads with a 40.8% market share in 2024, driven by AI and ML technologies that enhance real-time threat detection and automate compliance processes.

By End User:

- Banks

- Insurance Companies

- FinTech Firms

- IT and Telecom

- Public Sector

- Energy and Utilities

- Others

Banks dominate with a 22% market share in 2024, using RegTech solutions for compliance management, transactional security, and automation of regulatory reporting to mitigate risks and enhance operational efficiency.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the market on account of the presence of many RegTech startups and established players, coupled with supportive government initiatives promoting regulatory compliance.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145