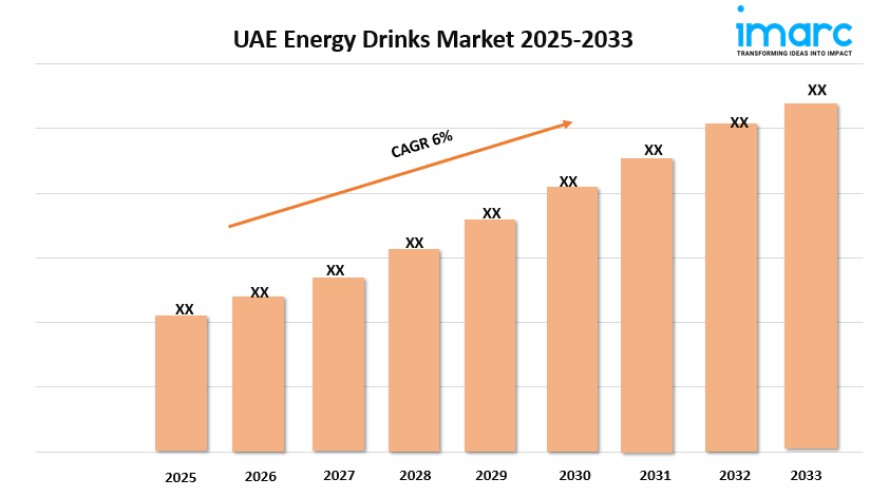

UAE Energy Drinks Market Growth, Size, and Forecast Report 2025-2033

The UAE energy drinks market size reached USD 232.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 391.3 Million by 2033, exhibiting a growth rate (CAGR) of 6% during 2025-2033.

UAE Energy Drinks MarketOverview

Market Size in2024:USD 232.6 Million

Market Size in2033:USD 391.3 Million

Market Growth Rate 2025-2033:6%

According to IMARC Group's latest research publication,"UAE Energy Drinks Market Report by Product (Non-organic, Organic, Natural), Target Consumer (Teenagers, Adults, Geriatric Population), Distribution Channel (Offline, Online), and Region 2025-2033", theUAE energy drinksmarket size reachedUSD 232.6 Millionin 2024. Looking forward, IMARC Group expects the market to reachUSD 391.3 Millionby 2033, exhibiting a growth rate(CAGR) of 6%during 2025-2033.

Growth Factors in theUAE Energy Drinks Market

- Rising Health Consciousness and Active Lifestyles

The UAEs increasing focus on health and fitness is a significant driver for the energy drinks market. Consumers, particularly younger demographics like Millennials and Gen Z, are adopting active lifestyles, engaging in gym routines, sports, and outdoor activities. Energy drinks are perceived as convenient solutions to boost stamina and performance, especially among fitness enthusiasts. For instance, brands like Red Bull have capitalized on this by sponsoring local sports events, such as marathons in Dubai, aligning their products with the active lifestyle trend. This growing health awareness encourages consumers to seekenergy drink uaeproducts that complement their fitness goals, driving market expansion.

- Innovative Product Diversification

Energy drink manufacturers are expanding their portfolios to include innovative variants like sugar-free, low-calorie, and natural ingredient-based options, catering to diverse consumer preferences. For example, in 2023, Monster Energy launched Monster Energy Zero Sugar in the UAE, targeting health-conscious consumers seeking caffeine without sugar. Similarly, BCS Globals introduced WOX Energy Drink with unique variants like BCAA and Zero Edition, appealing to niche markets such as fitness buffs and those avoiding artificial additives. This diversification not only broadens the consumer base but also sustains interest by offering tailored solutions for different tastes and health-conscious lifestyles, fueling market growth.

- Expanding Retail and E-Commerce Channels

The growth of retail networks and e-commerce platforms in the UAE significantly boosts the energy drinks market. Hypermarkets, supermarkets, and convenience stores like Carrefour and Spinneys make energy drinks widely accessible, while online platforms offer convenience and variety. For instance, Amazon.ae and Noon have seen increased sales of energy drinks due to promotional offers and detailed product information, appealing to tech-savvy consumers. This accessibility encourages impulse purchases and brand exploration, particularly among younger consumers who prefer online shopping. The expansion of these distribution channels ensures energy drinks reach a broader audience, supporting sustained market growth.

Key Trends in theUAE Energy Drinks Market

- Shift Toward Healthier Formulations

A prominent trend in the UAE energy drinks market is the shift toward healthier formulations, driven by consumer demand for transparency and wellness-focused products. Brands are reformulating drinks to include natural ingredients like green tea extract, ginseng, and B-vitamins, moving away from high sugar and synthetic additives. For example, brands like G Fuel have gained traction by offering low-sugar, nootropic-enhanced drinks that appeal to gamers and professionals seeking mental clarity. This trend aligns with the UAEs health-conscious culture, where consumers prioritize products that support both physical energy and overall well-being, reshaping market offerings.

- Digital Marketing and E-Sports Partnerships

Energy drink brands are increasingly leveraging digital marketing and partnerships with e-sports to reach younger audiences. The UAEs growing e-sports scene, with events like the Dubai Esports Festival, has prompted brands like Red Bull and Monster to sponsor gaming tournaments and influencers, creating strong brand loyalty among Gen Z. For instance, Red Bulls sponsorship of local gaming events has positioned it as a lifestyle brand for tech-savvy youth. Social media campaigns on platforms like Instagram and TikTok further amplify brand visibility, using vibrant designs and celebrity endorsements to drive engagement and sales in the competitive market.

- Rise of Functional and Nootropic Drinks

The demand for functional and nootropic energy drinks is rising in the UAE, as consumers seek beverages that enhance cognitive performance alongside physical energy. These drinks, infused with ingredients like L-theanine and ginkgo biloba, cater to students, professionals, and gamers who prioritize focus and mental clarity. For example, Magic Mind, a U.S.-based startup, has entered the UAE with its nootropic shots, combining matcha and adaptogens for sustained energy without jitters. This trend reflects the UAEs fast-paced, competitive environment, where consumers value multifunctional beverages that support productivity and mental wellness, driving innovation in the market.

Download a sample PDF of this report:https://www.imarcgroup.com/uae-energy-drinks-market/requestsample

UAE Energy DrinksIndustry Segmentation:

The report has segmented the market into the following categories:

Product Insights:

- Non-organic

- Organic

- Natural

Target Consumer Insights:

- Teenagers

- Adults

- Geriatric Population

Distribution Channel Insights:

- Offline

- Supermarket/Hypermarket

- Mass Merchandiser

- Drug Store

- Food Service/Sports Nutrition Chain

- Others

- Online

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Future Outlook

The UAE energy drinks market is poised for robust growth, driven by evolving consumer preferences and a dynamic lifestyle culture. As the region continues to prioritize health and fitness, brands will likely invest in organic and natural formulations to align with health-conscious trends, while expanding their presence in e-commerce and physical retail to capture a broader audience. The growing popularity of e-sports and digital platforms will further amplify marketing efforts, with brands forging deeper connections through influencer partnerships and immersive campaigns. However, challenges like regulatory scrutiny over caffeine content and health concerns may push manufacturers to innovate safer, transparent products. With the UAEs young, urban population and increasing disposable incomes, the market is set to thrive, offering diverse, functional beverages tailored to modern lifestyles.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145