UAE Dairy Market Growth, Share, and Trends Report 2025-2033

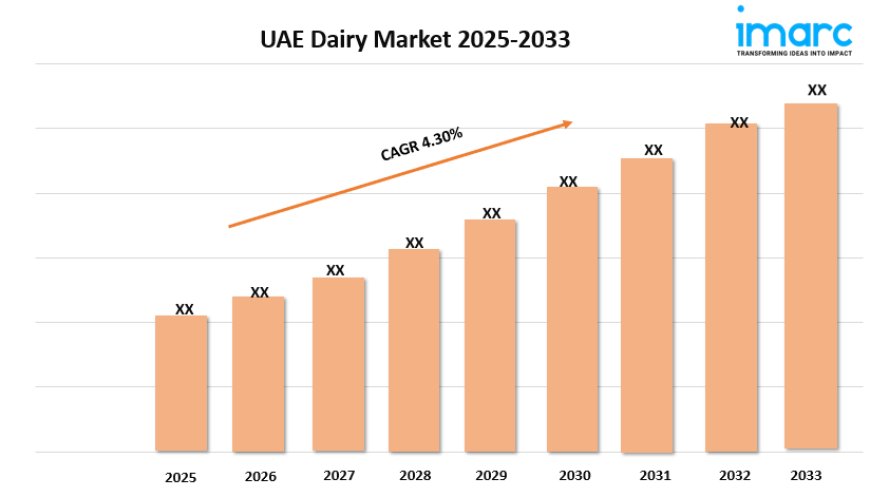

UAE dairy market size was valued at USD 4.8 billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.0 billion by 2033, exhibiting a CAGR of 4.30% from 2025-2033.

UAE Dairy Market SizeOverview

Market Size in2024:USD 4.8 Billion

Market Size in2033:USD 7.0 Billion

Market Growth Rate 2025-2033:4.30%

According to IMARC Group's latest research publication,"UAE Dairy Market Size, Share, Trends and Forecast by Product Type, and Region, 2025-2033", the UAE dairy market size was valuedatUSD 4.8 billionin 2024. Looking forward, IMARC Group estimates the market to reachUSD 7.0 billionby 2033, exhibiting aCAGR of 4.30%from 2025-2033.

Growth Factors in theUAE Dairy Market Size

- Rapid Population Growth and Urbanization

The UAEs booming population, driven by a high expatriate influx and urban expansion, significantly fuels the dairy market. Cities like Dubai and Abu Dhabi are home to diverse communities with varied dietary preferences, increasing demand for dairy products like milk, yogurt, and cheese. For instance, the growing number of families in urban centers has led to higher consumption of fortified milk for children, addressing calcium deficiencies noted in local health reports. This demographic shift encourages dairy companies to expand production and diversify offerings, catering to both local Emiratis and expatriates who incorporate dairy into daily meals and traditional dishes.

- Rising Health Consciousness Among Consumers

Health awareness is a key driver in the UAE dairy market, as consumers increasingly seek nutritious and functional foods. Dairy products, rich in calcium, protein, and probiotics, align with this trend. For example, Al Ain Farms introduced lactose-free milk and yogurt, catering to health-conscious individuals with dietary restrictions. Fitness enthusiasts also drive demand for high-protein dairy, such as Greek yogurt, reflecting the UAEs growing fitness culture. Public health campaigns, like those by the UAE Ministry of Health, emphasize dairys role in preventing osteoporosis, further boosting consumption among women and children.

- Supportive Government Initiatives

Government efforts to enhance food security and reduce import dependency propel thedairy industry in uae. Initiatives like subsidies for local dairy farms and investments in sustainable production technologies encourage domestic growth. For instance, Sharjahs Meliha Dairy Factory, supported by the Department of Agriculture, adopts organic methods to meet rising demand for premium products. These policies not only strengthen local brands like Al Rawabi but also attract international players, fostering innovation and competition. By prioritizing self-sufficiency, the government creates a stable environment for dairy producers to thrive.

Key Trends in theUAE Dairy Market

- Surge in Functional and Fortified Dairy Products

Consumers in the UAE are leaning more toward dairy products with health benefits. These include probiotics, vitamins, and omega-3. This trend shows a shift to preventive healthcare. For instance, Danones Activia yogurt, which has probiotics, is popular for gut health. Fortified milk with vitamin D helps with regional deficiencies, attracting health-conscious families. Dairy companies are investing in research to create new products. They aim to meet changing consumer needs for taste and nutrition. Functional dairy is becoming a key part of market growth.

- Growth of E-Commerce and Online Retail

E-commerce is changing dairy distribution in the UAE. It gives busy urban consumers more convenience. You can easily buy dairy products on platforms like Noon and Amazon Fresh. They offer everything, from camel milk to artisanal cheeses. Camelicious uses online channels to reach global markets. It exports to more than 16 countries. This trend has sped up since COVID, as shoppers prefer contactless options. Dairy brands are improving their digital marketing and logistics. They want to ensure fresh deliveries to tech-savvy customers.

- Demand for Sustainable and Long-Life Packaging

Sustainability is changing the UAE dairy market. Consumers prefer eco-friendly packaging and long-lasting products. Almarai and other companies are using recyclable materials. They also use energy-efficient methods to meet these demands. For instance, Meliha Dairy Factory in Sharjah introduced sustainable packaging in 2024. This move attracts eco-conscious buyers. Long-life milk and powdered dairy products are gaining popularity. This includes skimmed milk powder used in infant formulas. They offer convenience and reduce waste, showing the UAE's commitment to sustainability.

Download a sample PDF of this report:https://www.imarcgroup.com/uae-dairy-market/requestsample

UAE DairyIndustry Segmentation:

The report has segmented the market into the following categories:

Analysis by Product Type:

- Liquid Milk

- Flavored Milk

- Cream

- Butter

- Cheese

- Yoghurt

- Ice Cream

- Anhydrous Milk Fat (AMF)

- Skimmed Milk Powder (SMP)

- Whole Milk Powder (WMP)

- Whey Protein

- Lactose Powder

- Curd

- Others

Regional Analysis:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Future Outlook

The UAE dairy market is set for strong growth. This growth comes from diverse populations, health trends, and new technology. Local brands like Al Rawabi and Al Ain Dairy are innovating. They are adding plant-based and organic options to match changing tastes. Government support for sustainable farming will boost local production. It will also cut down on reliance on imports. E-commerce growth will also improve market access. But the market faces challenges. Global brands create tough competition, and raw material costs can change unexpectedly. By using digital platforms and sustainable practices, the UAE dairy sector can thrive. It will offer high-quality, health-focused products to an expanding consumer base.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145